The first money you raise shapes more than your business — it shapes your relationships, discipline, and future decisions.

Many founders rush into Friends & Family funding without fully understanding the emotional, financial, and operational risks.

Others raise money, show profits, but slowly lose control of cash — only to realise too late that profit does not mean survival.

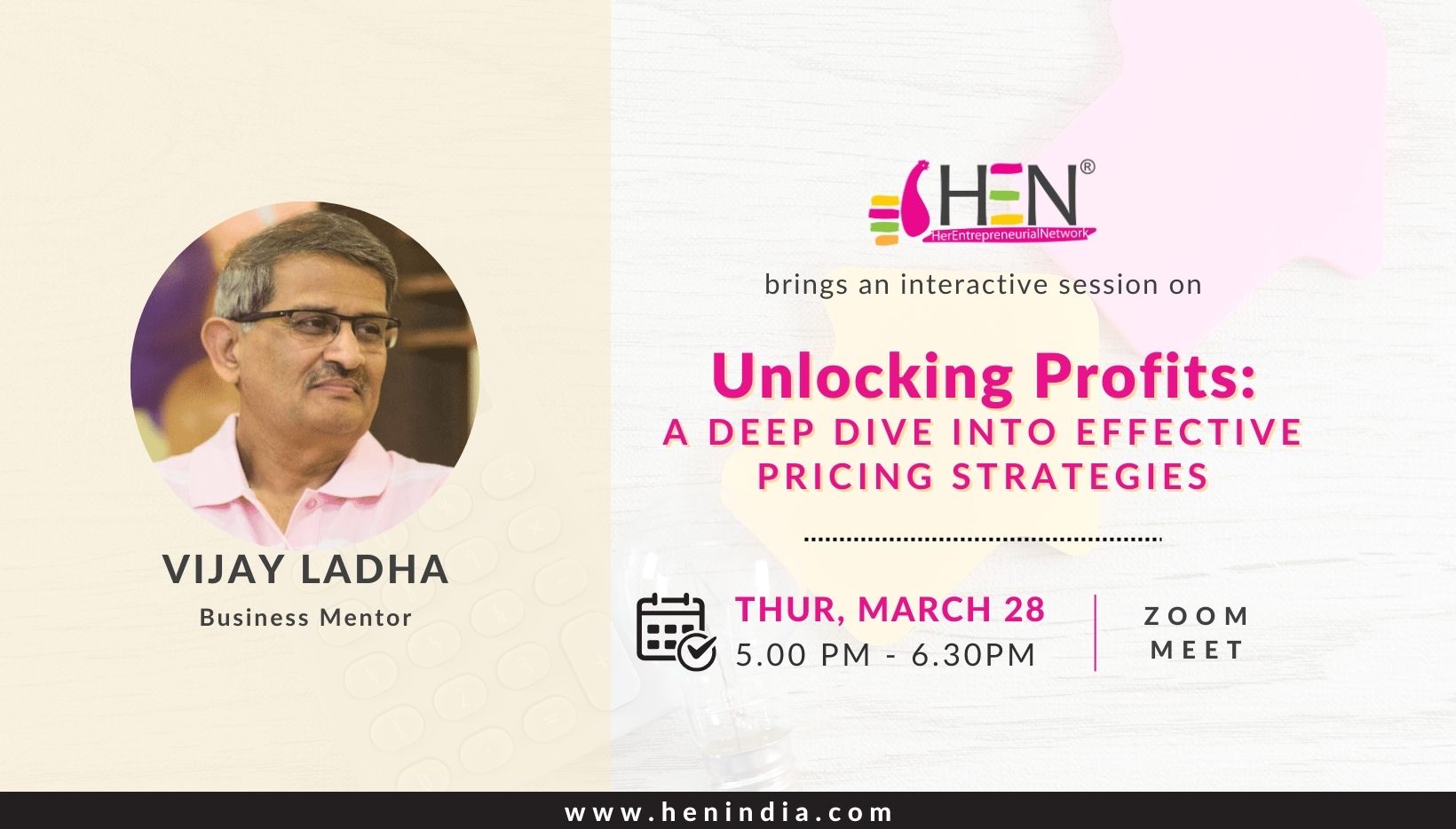

This HEN Meet is designed to help founders raise early capital responsibly and build cash discipline from Day 1, so businesses stay healthy and relationships stay intact.

This is not a legal or finance-heavy session.

It’s a founder-awareness session — practical, honest, and grounded in real decision-making.

What You’ll Learn

👉 What Friends & Family funding really is — and what it is not

When this capital helps you grow, and when it quietly becomes a liability.

👉 When to raise (and when not to)

A simple founder-readiness checklist to decide timing wisely.

👉 How to structure your Friends & Family raise

How much to raise, how to think about valuation, which instruments to use, and what documentation actually matters.

👉 How to manage relationship risk

The hard truths, best practices, and one golden rule that protects both sides.

👉 Why cash flow matters more than profit

The difference every founder must understand — plus the five cash numbers you must track.

👉 A practical cash-flow framework

A simple 3-bucket system to manage expenses, founder salary, and spending discipline.

👉 How cash discipline improves fundraising

Why investors trust founders who respect capital — and how good cash habits signal readiness for growth.

Why This Session Matters

- Most startups don’t fail because of bad ideas — they fail because of poor cash discipline

- Early money raised without structure often damages personal relationships

- Investors back founders who show respect for capital before scaling it

If you’re thinking about raising from friends or family — or have already done so — this session will help you course-correct, protect trust, and build a stronger foundation.